Are farmers missing out on wealth from forestry?

Graham West, New Zealand Tree Grower August 2020.

The average farmer works extremely hard to create wealth for themselves and others. They face adversity of all types but get up each morning determined that growing more grass and converting it into good food products will one day make them and their children well off. However, the challenging weather, the encroaching banks, the mounting environmental and health and safety compliance costs, all seem enough to stop a charging bull. Who in the farming leadership is asking − is this the only way to wealth and wellbeing? Are farmers really informed of the opportunities available for your land?

Among the many controversial opinions raised about land use and the environment, there has recently developed an anti-pine and anti-commercial forestry sentiment. Public opinion now suggests that forestry investment is not in the best interests of New Zealand.

This view seems to have come about from a lack of factual information and perhaps could be better informed. This article would like to address this view with some easy-to-find facts and figures which might let us answer the questions above with a little more openness and clarity.

Company financial performance

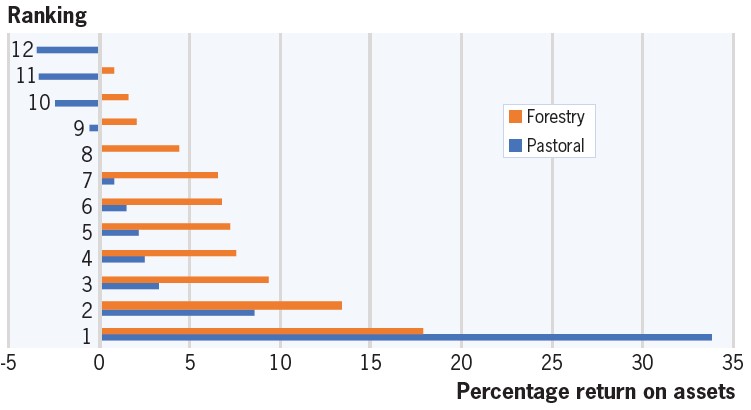

The excellent Deloitte’s summary of the top 200 New Zealand companies’ financial records, as published in the New Zealand Herald on 9 December 2019, provides data for an interesting comparison of how relevant large commercial enterprises are performing. The table on the previous page is taken from the summary and gives the financial performance of all 12 pastoral based companies and 11 forestry companies listed in the top 200.

| Sector | Company name | Profit in millions of dollars after tax | Assets in millions of dollars | Percentage return on assets | Profit in dollars per hectare |

|---|---|---|---|---|---|

| Pastoral | A2 Milk | 288 | 993 | 33.7 | - |

| Synlait Milk | 82 | 1,148 | 8.5 | - | |

| Open Country Dairy | 23 | 775 | 3.2 | - | |

| Dairy Goat Co-op | 6 | 261 | 2.4 | - | |

| Tatua Co-op Dairy | 5 | 255 | 2.1 | - | |

| Alliance Group | 7 | 96 | 1.4 | - | |

| Silver Fern Farms | 6 | 758 | 0.8 | - | |

| Westland Dairy | 1 | 588 | 0.1 | - | |

| Landcorp | -11 | 1,782 | -0.6 | -29 | |

| Oceania Dairy | -10 | 428 | -2.5 | - | |

| Fonterra | -605 | 17,074 | -3.4 | - | |

| ANZCO Foods | -27 | 68 | -3.5 | - | |

| Forestry | Matariki Forestry | 240 | 1,476 | 17.8 | 2,025 |

| Kaingaroa Timberlands | 584 | 4,731 | 13.3 | 3,172 | |

| Taumata Plantations | 214 | 2,367 | 9.3 | 1,252 | |

| Nelson Forests | 85 | 1,211 | 7.5 | 1,063 | |

| Pan Pac Forests | 75 | 1,092 | 7.2 | 2,115 | |

| Oregon Group | 107 | 1,610 | 6.7 | 963 | |

| Summit Forests | 20 | 347 | 6.5 | 812 | |

| Sumitomo Forestry | 25 | 532 | 4.4 | - | |

| Oji Fibre Solutions | 25 | 1,269 | 2.0 | - | |

| China Forestry | 4 | 272 | 1.5 | 181 | |

| Juken | 3 | 463 | 0.8 | 93 |

There are more farming and forestry companies, but they have not made the top 200. Presumably because they are in the top 200 group, this analysis reflects a high-performance group showing what well run companies in each sector can achieve.

Companies listed in the table are ranked by percentage return on assets. While most of the pastoral companies are processors and most of the forestry companies are growers, there is a stark contrast in the investment performance between them, with A2 Milk being the exception. This becomes more obvious when shown on a graph. If we assume that from profitable companies, we get reinvestment, and from reinvestment we get more jobs, where should we be putting our capital?

It seems unfortunate that many forests were invested in by overseas corporates and now make good profits and New Zealanders do not see that as an opportunity. Yes, this analysis could be more definitive with better data, but let us look at other sources.

Best land use

There have been many opinions that pastoral land is too good for forestry and that we will all suffer economically if we change too much land into forestry. Most of the large plantation forests have been planted on marginal land − a mixture of land use classes 6, 7 and 8 − which are often problem areas because of erosion, weeds or nutrient deficiencies.

The NZ Beef & Lamb Sheep & Beef Farm Survey reports in 2018/19 give average farm profit before tax for North Island hill country as in the range $325 to $450 a hectare each year.

This is for similar land to that used in forests but was developed into pasture 50 years ago or more. NZ Beef and Lamb report the average returns on farm capital for these properties is 1.6 to 3.5 per cent. Deloitte’sFacts and Figures report for companies with forestry on this class of land, an average return on capital of five to nine per cent. Using the forest companies’ area statements from the NZ Forest Owners Association we can calculate the nett profit per hectare, averaging over $1,000 a hectare each year.

| Export value comparisons | |||

|---|---|---|---|

| Category | Land use, million hectares 2016 | Export returns in billion dollars a year in 2019 | Export earned dollars per hectare per year |

| Horticulture | 0.19 | 6.1 | 32,158 |

| Dairy | 2.6 | 18.1 | 6,969 |

| Forestry | 1.7 | 6.9 | 4,077 |

| Meat and wool | 8.5 | 10.2 | 1,200 |

Comparing like with like

Dairy farms are currently expected to return nett profits of about $1,000 to $3,500 a hectare each year. Established and well managed forests on moderately flat land such as Kaingaroa in the central North Island are giving the same high return of $3,172 a hectare, with little or no environmental impact. Despite the sentiment that flat pastoral land is too good for forestry, when you compare like with like, a mature developed forest with a mature developed dairy farm on similar land, there is little difference in investment return. If we look at export earnings as an indication of national benefit, forestry again performs very well.

While some will say wood has experienced high prices in the last financial year, so has milk and meat. Forests are often misunderstood by farmers, because active people like to be busy accomplishing things every day. Forests do not need daily care and therefore seem non-intensive and below optimum returns.

The 25 to 30-year delay until timber harvest is also seen as a major hurdle and financially unworkable if there is a mortgage to pay. However, new forests will be allowed to use the averaging rules of the Emissions Trading Scheme which greatly change the cashflows. Selling carbon credits could supply farmers with enough interim cash flow to reduce debt, carry out farm improvements or develop a range of forest age classes that could give a frequent timber harvests from part of their property.

Growing trees to offset emissions on leased marginal land has not been well understood, but this method offers dairy farmers a way to address the voluntary emission scheme they have agreed to develop. While carbon prices are currently around $30 a tonne, the upper limit managed by supply of government units is proposed to be $50 a tonne. Carbon price could be the big influencer in forestry by significantly changing cashflows.

Woodlot location

Scale is often raised as an impediment to good forestry returns but a recent survey of farm foresters proves that high returns per hectare can be earned from small, well-managed woodlots. Location is the factor which has the greatest effect. Moderate contour land close to mills or ports can be very profitable. Land which is steep and remote has high forestry costs and is not suited to short rotation timber harvests.

However, forestry does have a very different pattern of employment from farming. To help with this, farmers need to integrate forestry into their business planning and use farm labour in tree crops, then there is not much change to the social demographics.

Better information needed

On balance, the public have not been well informed about the wealth created by forestry, and farmers have not been well informed about the opportunity forestry offers them in terms of more resilient cashflows and environmental mitigation. The average Jack and Jill farmer deserves better factual information and less rhetoric about forestry than what we have read over the last 12 months.

The culture of livestock farming is not threatened by the culture of forestry, attending a farm forestry field day will prove this. Many farm foresters have had very profitable harvests in recent years. Trees make you feel good, and the cheques that arrive after harvest make them feel even better. At future A & P shows and field days we will hopefully see better forestry information services and improved integration and understanding.

Graham West is currently the Public Relations Spokesman for NZ Farm Forestry Association. A condensed version of this article was printed in Farmers Weekly on 25 May 2020.

Farm Forestry New Zealand

Farm Forestry New Zealand