China’s wood market overview

Michael Wang, Bruce Cheeseman, Karen Bayne, Tanira Kingi, Tim Barnard and Peter Clinton, New Zealand Tree Grower May 2020.

This article was originally written in 2019 but was updated this year particularly with reference to the effects of the Covid-19 pandemic.

Wood is a renowned sustainable material compared to other popular conventional materials including steel, concrete and plastic. Wood is used as a building material as well as being widely used in other industries, such as furniture, paper and fibre. Moreover, with the rapid development of manufacturing technology, combined with the increasing number of new wood materials invented by scientists, there is a significant potential demand for the resulting wood products.

The forestry sector plays a vital role in New Zealand’s economy. According to the latest figures from Statistics NZ, forestry has the third largest export value of around $5 billion a year. For the past two decades, China’s economy has rapidly increased. Today, China has become the world’s second largest economy by nominal gross domestic product and the largest economy by purchasing power parity. Although the Chinese economy was slowing, it remains the world’s largest market by purchasing power parity with its population base of 1.42 billion.

China is New Zealand’s largest trading partner. Two-way trade including exports and imports of goods and services between China and New Zealand is over $32 billion. The New Zealand-China free trade agreement upgrades are designed to remove tariffs from New Zealand wood and paper products over a 10-year implementation period, worth $36 million in trade to China.

It is very relevant, therefore, that New Zealand forestry businesses understand Chinese wood market. The following section introduces China’s wood trade, then the important trends in China’s wood market with the last section summarising the market challenges and outlook for China including the Covid-19 effect.

China’s wood trade

In China, all land including forests, is technically owned by the State. Before 1978, China’s forestry resource was organised by the central government. However, China’s forestry trade and investment policies have changed significantly over the last decades. China’s forestry industry has gone through three periods −

- Full state-centred procurement and allocation before 1985

- The co-existence of state control and market liberalisation between 1985 and 1998

- Liberalisation under government regulation after 1998.

The current market consists of different types of enterprises.The following types are commonly found in China − state-owned industrial enterprises, foreign invested enterprises, joint venture enterprises and private enterprise.

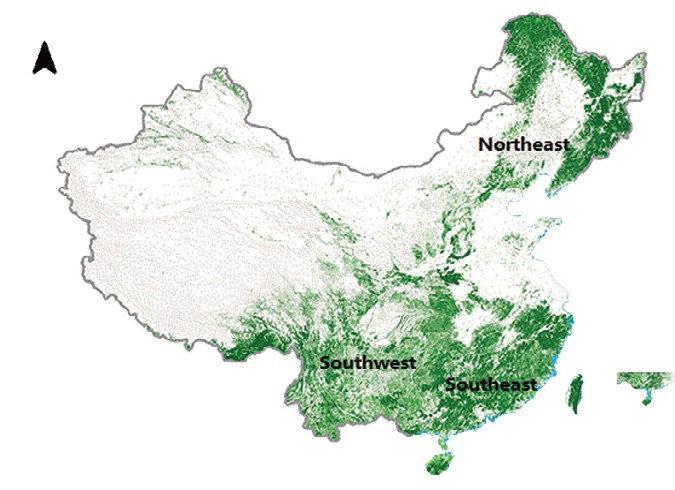

In today’s China the forest area is 208 million hectares.The wood resources are mainly distributed in three major areas.The north east region, including Heilongjiang, Jilin and the Inner Mongolia. The south west region including the Sichuan and Yunnan provinces. The south east region including Guangdong, Guangxi, Hunan, Hubei, Fujian, Jiangxi, Guizhou, Zhejiang,Anhui, and Hainan. This last region is associated with the three main wood trading regions in China namely Guangdong, Shanghai and Sichuan.

In 2017, a national ban on domestic commercial logging was announced in China. The map indicates the three main forest areas.

In 2012, Guangdong officially released the first domestic price index for wood products. The wood price index aims to provide real-time price information services to timber operators, manufacturing companies, research institutes and government agencies. The current price index was mainly based on the three major wood markets including Yuzhu timber market in Guangdong, Furenlin product market in Shanghai and Southwest Building Materials Market in Sichuan.

China is the world’s largest manufacturing nation and it is the only country with all industrial categories in the UN Industry Classification. The various wood products manufactured in China supply the domestic market as well as export to foreign countries such as the US and Japan. China mainly imports raw materials such as logs and exports processed wood. The two types of export- processing trade are pure assembly and processing with imported materials.

Trends

China has been the world’s largest exporter of goods since 2009. China’s official report suggests that Chinese exports amounted to US$2.097 trillion in 2017. It is also the world’s largest wood production and timber processing exporting country. As a result, this requires large amounts of raw materials, such as wood, to sustain the production.

During the last decade, China’s total wood consumption increased from 380 million cubic metres in 2007 to 600 million cubic metres in 2017, with an average annual growth rate of 4.67 percent. China is increasingly exporting wood in value-added products.

Increased demand for wood

The wood processing industry plays an important role in China’s economy. China’s wood is mainly consumed for paper, wood-based panels, solid wood flooring and solid wood furniture. According to the statistics of the China Wood and Wood Products Circulation Association Information Centre, the output value of the wood industry in 2017 reached 2.11 trillion yuan or NZ$465 billion, a year-on-year increase of 5.64 percent. The output value of the wooden door industry reached 146 billion yuan, a year-on-year increase of 10.6 percent. The total sales volume of the flooring industry was 415 million square metres and the demand for high-quality wood flooring increased.

The output of the wood-based panel industry reached 315 million cubic metres. In recent years, the growth of the custom home furnishing industry has been strong, and the growth rate of brand enterprise revenues has exceeded 30 per cent. In 2017, China’s solid wood furniture industry achieved operating income of 578 billion yuan, a year-on-year increase of 6.4 percent.

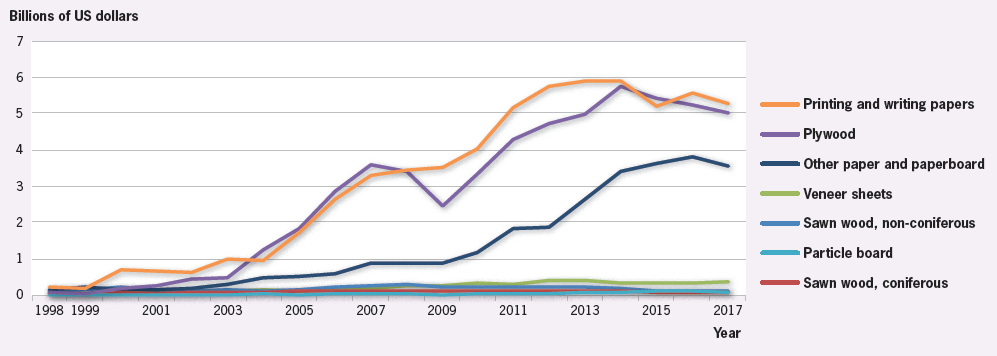

The development of a global economy continued to accelerate the demand for China’s wood products. The graph below, according to the data from Food and Agriculture Organisation of the United Nations, shows the export value of China’s forestry trade between 1998 and 2017. The export value of the secondary processed wood products is growing rapidly, such as paper, plywood, paperboard and veneer sheets. The export value does not include other secondary processed wood products such as wooden furniture and wooden household goods. However, this graph clearly shows the increased wood demand for China’s forestry trade and export.

Increased wood imports

China is the world’s largest importer of logs and the second largest timber consumer in the world after the United States. In 2017, the import volume of timber in China reached about 108 million cubic metres. Not surprisingly, China is the largest importer for the New Zealand forest sector. In 2018, New Zealand exported record volume of logs to China.

China heavily relies on imports of wood in raw log form and sawn timber. In the last decade, the volume of wood imported has increased from 50 million cubic metres to over 100 hundred million cubic metres in 2017. With the increase of labour and transportation costs and the changes in consumption structure, the sawn timber trade has increased. Imported timber prices are running smoothly. A customs report indicated that in the past five years, the price of softwood has been relatively stable, and the price of hardwood has soared in the Chinese domestic market. China’s dependence on the imports of wood and wood products is increasing rapidly. In 2018, over 50 percent of China’s total wood consumption was imported from overseas. One of reasons is due to regulation changes – the blanket ban in China on domestic commercial logging in 2017.

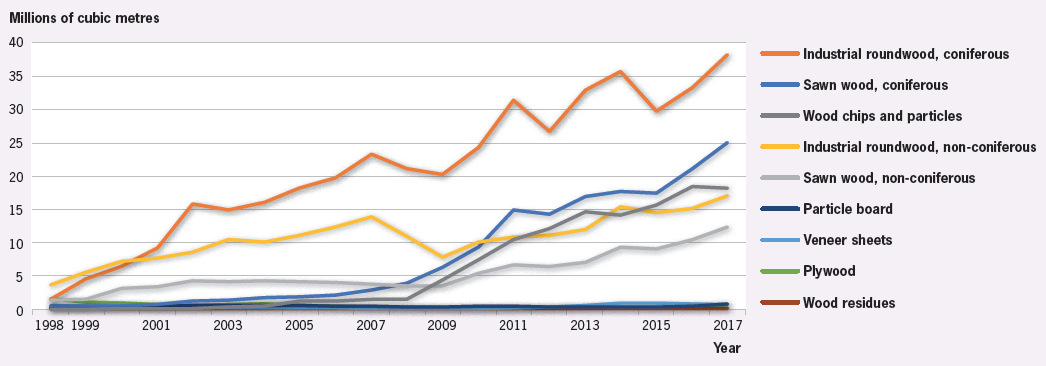

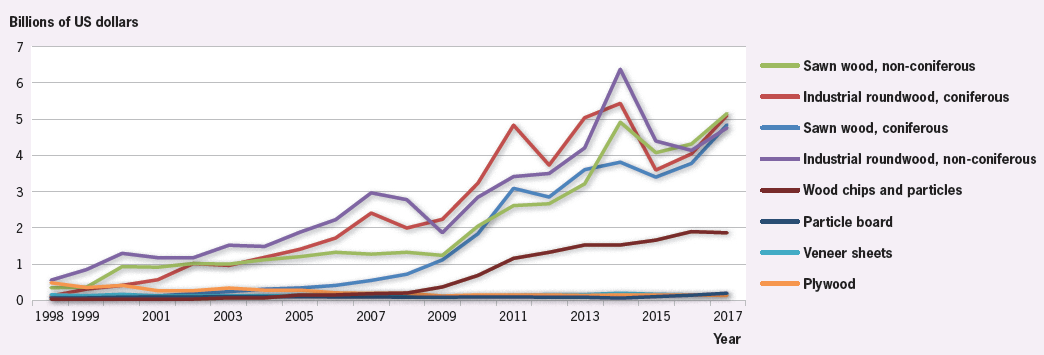

According to the Food and Agriculture Organisation’s data, the following figures illustrate the import volume and value of China’s forestry trade between 1998 and 2017. Notably, most import wood products are logs and timber. There has been a significant increase in imported timber.

Russia has become China’s major timber exporter with over 30 percent of China’s total timber imports from Russia. In the last five years, timber shipments from Russia have doubled due to changes in trade policy placing heavy tariffs on exports of unprocessed logs. From 2012 to 2017, the greatest change on the log supply side is that Australia almost tripled their shipments. Over 60 percent of China’s total imported timber was from four countries including Russia, United States, New Zealand and Canada.

Challenges and outlook

China’s economic development stimulated government’s investment in forest restoration and conservation programmes in particular the Natural Forest Protection Programme and Forest Shelterbelt Programmes in Key Basins. However, this resulted in some challenges to their domestic timber production and manufacturing industries. New Zealand is China’s largest supplier of coniferous logs, and some of these challenges might become opportunities for New Zealand producers.

First is China’s national environmental protection policy and logging ban in natural forests. China has completely suspended commercial harvesting in natural forests, and the supply of domestically produced timber has decreased. It was expected that by 2020, the volume of China’s domestic timber supply shortage would reach 200 million cubic metres. Imported wood has become the main source of timber production in China.

Secondly, pollution prevention has become China’s national policy. The Chinese government intends to shut down polluting enterprises for environmental protection. In China’s timber industry, poor investment in environmental protection and safety production of wood products enterprises is prominent. For example: the plywood industry has been listed by the Ministry of Environmental Protection as a ‘two high’ industry − high pollution, high environmental risk − and the industry will face greater uncertainty in the future. Thirdly, the timber industry is labour intensive.

The rapid increase in Chinese labour costs, rising raw material prices and intense competition means that China’s timber industry faces pressure to upgrade technology. Moreover, the Chinese timber processing firms have other problems including insufficient research and development and low value-added production.

Finally, China’s economic slowdown is a big challenge. According to Bloomberg News, China is facing its most difficult economic environment in years. Growing number of manufacturers moved their supply chains from China to south east Asia. This would add additional uncertainty to the China’s forestry markets in the future. Nevertheless, it is probable that China will become the largest economy in the world by 2030.

Paying attention

We need to pay more attention to this important consumer market in the world. The outlook of the China’s wood market can be summarised in the points outlined below.

Firstly, the Chinese timber market has large potential and wood consumption will continue to grow. As a low-carbon, green and renewable household product, wood is increasingly favoured by consumers. Currently, China’s per capita annual wood consumption is less than 0.4 cubic metres, but it is expected that total wood consumption will exceed 800 million cubic metres in the next few years.

Secondly, industry concentration is further enhanced. Market resource allocation is concentrated in large enterprises and big brands. The pace of enterprise innovation and transformation is accelerating to keep up with increased consumers’ awareness of quality, brand and service.

Thirdly, whole house customisation has become a new outlet for the China’s timber industry. The upgrading of the consumption structure has promoted the rapid development of smart homes, integrated customisation and one-stop services. It is predicted that customised homes will maintain a growth rate of more than 20 percent, and the market size was expected to reach 160 billion yuan or NZ$35 billion in 2020.

Fourthly, the One Belt One Road initiative supports more Chinese companies, including forestry and timber companies, to expand their business internationally. At present, the total overseas investment of timber and wood products enterprises in China has reached over US$1.8 billion. China is also an important investor in New Zealand forestry sector.

Overall, China is New Zealand and the world’s largest importing log market. The changes of China’s wood market significantly influence the international forestry value chain. We have highlighted some important trends, challenges and outlook in the Chinese market. This article is part of the Chinese log price research project, conducted by the Scion value chain optimisation team and it may provide insights into New Zealand forest management.

Effects of Covid-19

This article was prepared in 2019. At that time we did not anticipate the recent Covid-19 outbreak which appeared in China at the beginning of December 2019. As we all know, it is now affecting more than 190 countries including New Zealand. It has also had significant effects on the China wood market.

As Covid-19 continues to spread, the growing uncertainty in the market place makes it difficult to predict short-term trends. Having said that, we recently conducted a survey to understand the perceived current effects of Covid-19 in the New Zealand forestry business. Results show that the New Zealand log export market expects a decline, due to the effects of Covid-19 on overseas log markets including China.

The significant drop in log export price in China in February 2020 caused interruption to normal operations such as in voyage fumigation, decreased harvesting, reduced production and falling cash flow. Some respondents highlighted their concerns about disrupted log supplies, cancelled orders, lack of staff and fear of staff contracting the virus in the work place. Results also show that pulp and log prices are recovering in China as there is no supply from Europe, with some respondents indicating that their margins increased due to the low New Zealand dollar.

The coronavirus outbreak has also caused severe international logistics disruption and delays. As China is the largest trading partner of New Zealand in goods and second largest overall including trade in services, New Zealand companies need to prepare a contingency plan to cope with the major effects on the international supply chain operations and industrial production.

The China–United States trade war

Apart from the effects of Covid-19, the China-United States trade war, which is an economic conflict between China and the United Sates, has significant effects on the global economy. In January 2018, US President Donald Trump started setting tariffs and trade barriers on China’s products. Later, China responded by imposing additional tariffs on products it imports from the US, including soybeans, fruit, pork, aluminium, aeroplanes, cars and steel piping. Deliberate escalation of tariff actions have taken place one after another. In late September 2019, Chinese retaliatory tariffs on US timber and wood products caused timber exports to China to fall 40 per cent, resulting in increased log prices and demand in China for sawn timber during that time.

In January 2020, China and US signed the US– China Phase One trade deal. China’s Tariff Commission unveiled new lists to exempt some of the US imports including timber, presswork, hydraulic motor, diaphragm pump, aircraft parts and medical equipment. This provided a positive signal for the global trade. However, due to the effects of Covid-19, the Chinese 2020 spring festival holiday was extended, manufacturers and companies ordered to halt their operations and residents required to stay at home. The disruption obviously has had negative economic effects on China’s manufacturing and domestic wood market.

As the situation changes daily, it is difficult to observe the full effects of Covid-19 and the trade war on New Zealand supply chains at this stage. But New Zealand companies should anticipate further effects in the next few months.

All the authors work at Scion. Dr Michael Wang is a researcher, Bruce Cheeseman is a business analyst, Karen Bayne is a senior research scientist, Dr Tanira Kingi is a research leader in primary industry systems, Tim Barnard is an associate science leader and Dr Peter Clinton is a science leader.

Farm Forestry New Zealand

Farm Forestry New Zealand