Carbon update

Piers MacLaren, New Zealand Tree Grower November 2008.

The Emissions Trading Scheme (ETS) is now law. The rules regarding forestry may bring great riches to some, great pain to others, and a shrug of the shoulders to everyone else. How will it affect you? That depends on the size and age of your forests, the type of land they were planted on, and what you intend to do with that land eventually.

Many of the background rules and definitions were covered in my article in the February edition, and to save space I do not intend to repeat them here. If you are new to this complex topic, I suggest you re-read that article before trying to absorb this one.

However, first some good news. You can now register anytime before 2012 to decide what to do. If by that time you have not got round to registering your sinks, the worst that can happen is that your carbon up to the end of 2012 will become the property of the government.

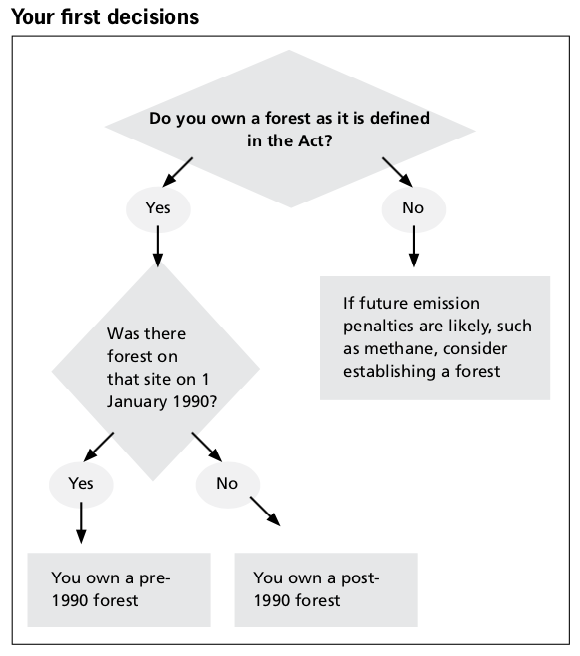

This article is designed around several decision trees. If you react badly to such diagrams, I will also explain your choices in words, as well as justifying my conclusions.

What type of forest do you own?

Go through your landholding, classifying each hectare according to whether it is a forest or not. Remember that there are tight specifications as to what constitutes a forest under the Act. Work out which of these areas were forested on 1 January 1990. You now have two distinct categories of forest – pre-1990 and post-1989 forests.

What future do you envisage for your pre-1990 forest?

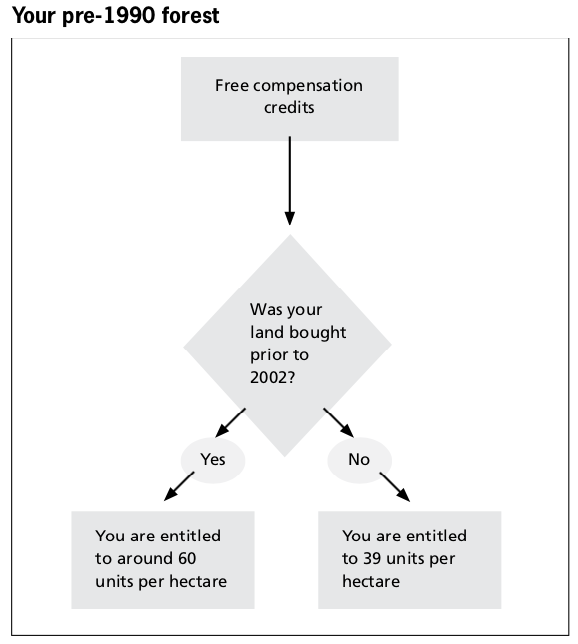

If you have no intention of deforesting that land, by converting it to some other non-forestry use, then the situation is fairly simple. You can apply for free compensatory carbon credits − New Zealand Emission Units in the jargon − so long as your trees are planted ones rather than native bush. You must apply by 30 June 2009. If your land was acquired before or in 2002, you can claim approximately 60 units of carbon dioxide equivalent per hectare, if it was acquired after 2002 you can claim only 39 units. You should do this, you have nothing to lose. The units are currently valued at between $10 and $45 each, but could be worth far more or less if and when trading becomes widespread.

If you intend some time to deforest that land – or sell it to someone who may wish to deforest it – then the situation could be somewhat trickier. If the land area is less than two hectares, just do it and do not bother to tell anybody. If it is between two and 50 hectares, you can deforest it with no penalty – but only if you have obtained permission to do so. I understand that MAF will handle this, but the relevant forms are not yet available.

If you own more than 50 hectares of pre-1990 forests that has some valuable non-forestry use, then you are right out of luck. Your land has probably been devalued enormously as a result of this legislation because non-forestry buyers will not be there at the auction. The 60 or 39 units per hectare mentioned above were designed to compensate forest owners in a minuscule way for this huge loss of land value. To put things in perspective, you might need to buy up to 800 units per hectare to be allowed to go ahead with land conversion to, say, dairy farming.

What future do you envisage for your post-1989 forest?

If you intend to deforest your post-1989 trees, or to allow the possibility of someone in the future deforesting that land, one solution is simple − do not opt into the ETS. Do not claim any credits, and they will automatically revert to government ownership along with the associated liabilities. The liabilities include carbon losses from any source, be it harvesting, windthrow or deforestation. You can fell your trees, sell the wood as you always intended to do, convert the land to whatever use you like, and forget about carbon. The only problem is that you have potentially missed out on a lot of money.

If you have no intention of changing land use on that land, I suggest you uplift all the credits to which you are entitled. Uplifting is different from selling and will not cost you a prohibitive amount. You can then choose if or when to sell them – you have the option of banking all or part.

For example, you may decide to retain some of them to cover future liabilities from livestock emissions or from harvesting, or just to keep for a rainy day. Even if there is a mere possibility of deforestation someday, you could consider uplifting your credits and just hanging on to them – the government cannot ask you to pay more for your deforestation than the credits you have received under the ETS. At least, those are the rules for post-1989 forests in the 2008-2012 period. If you eventually decide to keep the land in a forest cover rather than converting it to some other use, you could be grateful for those credits sitting in the bottom drawer.

Credits an incentive for future afforestation

After taking part in a major MAF contract earlier this year, I have changed my mind regarding the value of carbon credits as a forestry incentive. Credits could be a powerful incentive for future afforestation. This study, led by the School of Forestry at Canterbury University, looked at numerous combinations of costs, prices and risks, and concluded that carbon payments vastly increased the profitability of forestry in all cases.

In most situations, with even a modest carbon price, forestry would be able to buy land at over $3,000 a hectare and still make a return of 8 per cent over-and-above inflation. The risk factor is over-rated, and I have been guilty in over-emphasising this in the past.

What species or regimes are best?

As a result of this exhaustive study we conducted for MAF, both Bruce Manley and I are convinced that high-volume and early-growth regimes are favoured by carbon trading. I had hoped that our investigations would herald a new dawn for alternative species, but unfortunately this was not the result we discovered. Radiata pine still comes out best.

But the best way to grow it is to plant the trees and walk away. Except for worries about disease or stability, do not thin and do not prune. You can still harvest the wood later – a lot later than normal – and the quality will be quite good as a result of the older trees and the higher stockings, but you would be sacrificing money by intensively tending your crop. Of course, this strategy assumes a future of reasonably high carbon prices and low timber ones as is currently the case. This situation could easily reverse, and anyway even if carbon is your primary objective, the timber revenue might tide you over carbon liabilities at harvest.

What about the risk?

If you accept credits for having removed carbon from the atmosphere, you must also take on board some responsibilities.You must maintain that carbon in perpetuity, and pay for any future reductions in carbon. A carbon loss may be due to your deliberate actions such as harvesting or deforestation, or it may be due to a natural disaster such as wind, fire or disease. The cause is irrelevant − you have to take responsibility for that loss. You can insure against some of the natural risks but not against all of them such as disease, and this is a regular cost or liability. For the deliberate actions of harvesting or deforestation, you can budget against the losses. Let me explain.

Many readers are self-employed, and would be quite familiar with the following situation. If you make a sale, a nice sum of money goes into your bank but you know that the money is not all yours – you are just caretaking a part of it. A certain proportion belongs to the IRD and must be paid when GST or provisional tax is due. Innocent newcomers to self-employment often run into difficulty by spending all their money whenever they get it, a bad mistake. You have to retain enough to cover your predictable outgoings. It is similar for carbon credits. When you harvest trees, you will need to surrender a certain quantity of credits, perhaps three-quarters of them, for a few years, before recovering them from the new crop of trees.

Dealing with the risk

So how can you deal with this? If you like avoiding risks whenever possible, sell only the quantity of credits that your trees might retain right through the harvest period, representing the carbon in stumps, roots and slash. This figure might be 240 tonnes of carbon dioxide equivalent per hectare. Then bank the rest.

How do I know this number? I have an excellent, and accurate, model based on the Farm Forestry Calculator sitting on my computer. No doubt in the fullness of time MAF will place a similar one on their website.

If you are risk taker, you can sell your carbon credits whenever there is a good price – and hope to buy credits back later if and when you need them. Who knows? Maybe the carbon market will collapse and you can earn real money now, but buy back worthless credits in the future. Of course the price trend could go the other way, so this is a very risky option.

If, like most people, you are somewhere in the middle of this range between risk-averter and risk-taker, you will want to sell the most credits possible at an acceptable level of risk. You can fill in the troughs in your predicted carbon budget in a large number of different ways. You can mix your rotation lengths, age-classes, species, and regimes to provide a more balanced carbon profile. This makes forestry a lot more complicated than previously, but it will also be a lot more profitable.

The no-harvest option

I know of a number of investors who are thinking of planting trees in isolated locations purely to gain carbon credits. They have absolutely no intention of extracting any wood from these areas. In other words, these people – just for the cost of establishing some trees with no pruning or thinning – will reap carbon payments for as long as the trees continue to pack on carbon.

What happens then? Undoubtedly, there will be a pulse of carbon back into the atmosphere as the trees collapse and rot. The so-called carbon farmer will have made his money and be long dead, given that trees can live for 50 to 500 years depending on species, but that is a problem for the farmer’s heirs. Or else it is a problem for the liquidator of the limited liability company into which the farmer has placed the assets, now liabilities, of his carbon farm.

New Zealand has perhaps a million hectares of inaccessible country that is capable of being planted in trees, and this could yield a good return.

It may cost a lot of money to successfully establish trees, but there is an easy solution for some fast movers. The Afforestation Grant Scheme is handing out money to people who want to plant trees. You can get about $1,800 a hectare to do so, merely by applying for it. The catch is that the government keeps your credits for the first 10 years, but this may not be such a major handicap. In the case of high-altitude sites or species such as Douglas fir there is no great gain in carbon over this period. After 10 years, you can elect to join the ETS and from then on it is all go.

Is this all cloud-cuckoo land?

Despite talking cats and croquet mallets made of live flamingos, Alice in Wonderland would have found the ETS very strange. This article gives you just a taste of this peculiar world. From January 2008 there is a potentially large group of carbon sellers − you and the farm foresters − and very few buyers. This is until the obligations start in 2010 for solid energy and other sources of stationary energy, and for emissions from industrial processes.

In 2011, liquid fuels kick in. Farmers, as you know, are exempt until 2013. So tree growers will need to make their decisions in the absence of reliable market signals, although there will be a lot of forward buying. Europe still does not want to be involved with our standard forestry credits, so it is misleading to use European prices as a guide.

The National Party would almost certainly revise the ETS. Their spokesman, Nick Smith, wants to align our scheme with the Australian equivalent. This may be clarified by March 2009 and may well exclude agriculture and have totally different rules for forestry. The international talks on the post-Kyoto protocol are to be decided at Copenhagen in December 2009, but my guess is that no agreement will be reached there. In summary, all this vast amount of wheeling-and-dealing may well come to nothing, while our planet continues to quietly do its thing – whatever that may be.

I am grateful to several MAF officials who have commented on the first draft of this article − Clive Lilley, Rob Miller, Peter Gorman and Gerard Horgan. I have changed the text where it was wrong or misleading, but have included my opinions even when they diverge from those of MAF.

Farm Forestry New Zealand

Farm Forestry New Zealand