Insuring carbon in your trees

Geoff Manks, New Zealand Tree Grower November 2010.

It is reasonable to ask how you can insure something which without help, you cannot see, hear or feel. Following the introduction of the ETS, forest owners who trade their carbon credits now face this issue − the asset and liability values of the carbon within their forests.

New Zealand has a long history of growing trees and exporting timber. The systems, processes and precedents involved in this industry are well understood by most of those involved, but it is only natural that the introduction of something new to this sector may take a while to swallow and then digest.

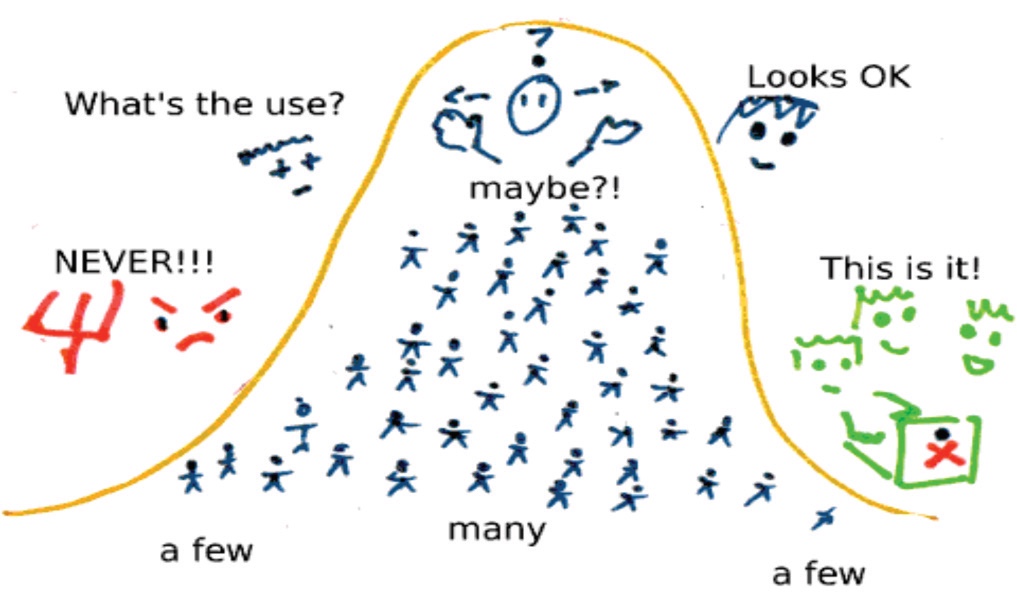

As with anything introduced, there is the predictable bell curve graph of those who adapt early versus those who never will. This applies to forest owners facing the dilemma of entering the ETS and what to do with carbon credits.

If the above reflects the uncertainty facing forest owners, given the potential financial benefits achievable perhaps it may be more of a lopsided curve towards the right. Possibly one of the stumbling blocks in the way of a rush to become part of the ETS is the uncertainly around obtaining appropriate risk protection or insurance for carbon trading activity. This subject seems to be causing some uncertainty with forest owners in New Zealand so an explanation may help.

What is being insured?

If we look at the tree, we first need to reconsider all that we have learned in the past 30 years and ignore the gate value of the timber as the means of setting the insured value. We are insuring a carbon forest, and as such, need to assess the asset value of the carbon in the tree now, and in the future. With a degree of certainty we can determine the actual value of a carbon tree or forest at any given time based on current and forward prices of carbon. Therefore with a market for carbon we can quantify the insurable value of the carbon in a tree.

The tree grown for timber is no different from one being grown for sequestering carbon. Two main areas of distinction between these forests is the value attaching to them and how an insurance claim needs to be settled. To highlight the differences between the two the following explanation may help provide some clarity.

Until a tree is cut down, it will have an estimated value at harvest of $x. If the tree is lost before that harvest date as the result of an unforeseen event such as fire or earthquake, the forest owner claims for the future lost earnings that would have been produced if the tree survived until harvest. This amount will be reduced by the value of the salvaged timber along with re-establishment costs to replant the affected area. Traditional insurer models are quite clear for determining the forests value and the increase in the insured value per hectare as the tree gets closer to harvest.

Tree B is in a carbon forest, and if a loss occurs then the owner has an immediate surrender liability to the government for all credits issued over the affected forest area. The measurement of this liability forms one part of establishing the insurable value. A number of credits would have been deemed to be released back into the atmosphere and therefore the forest owner must surrender an equivalent number back to the government.

As with tree A, we also need to add to this figure the re-establishment costs and loss of future earnings as a way of arriving at a final insurable value. Each forest owner will have a different view on what this may be worth, so the formula to arrive at these values is flexible. A final part of the equation can sometimes include the supply of credits to supplement any shortfall under an off-take agreement with an emitter.

What risks can you get covered?

Having worked through the process to arrive at an insured value for our carbon forest, we then need to know what risks we can get insurance against. Naturally if tree A is situated across the road from tree B, and they are of the same species and age, there really is very little difference in risk to the insurance company. The types of risks available to forest owners can vary depending on where the forest is but may often include the choice of the following −

- Fire from any cause other than excluded events such as war

- Malicious damage

- Impact from a land vehicle or aircraft

- Windstorm

- Volcanic eruption

- Earthquake

- Hail

In this example, because there is no significant risk difference between tree A and B, the factors which differentiate the premium which risks you want covered and the insured value of the forest.

Claim time

Now that the carbon forest is appropriately insured for the correct value and risks, the most important question of any insurance contract is how it will respond in a claim. Most traditional forest policies will settle the loss on the agreed value per hectare, less salvage and less deduction if the tree is in poor condition which would affect the yield at maturity.

For a carbon forest, because of the legislative implications on forest owners, such uncertainty is not acceptable. The value settled needs to be pre-agreed and understood so it is sufficient to meet the surrender obligations the owner will face, along with re-establishment costs and loss of future earnings. An appropriately structured carbon insurance contract will respond in this way and can be one of the single most important aspects to the forest owners’ insurance policy.

The local and international insurance markets are slowly responding to the needs of carbon forestry. Insurance solutions are available now to replace traditional timber insurance policies. These policies deal with the unique aspects associated with carbon credits, namely the valuation and settlement basis of carbon forests.

Forest owners who trade their carbon credits only need to maintain one insurance policy over their stand of trees, and do not need a policy for the timber and one for the carbon. As highlighted above, the carbon and timber insurance policies are effectively the same, but with several important technical changes made to reflect the unique implications carbon forests attract. Currently there are a limited number of insurers of carbon forests. Over time, the insurance market will respond more actively as the carbon credit sector develops, thereby creating more choice for forest owners when selecting their insurance carrier.

Geoff Manks is the managing Director of NZ Carbon Insurance, a company specialising in insuring carbon forests

Farm Forestry New Zealand

Farm Forestry New Zealand