Insure your trees and help benefit the NZFFA

Jo McIntosh, New Zealand Tree Grower November 2013.

Insuring trees is often overlooked, but standing timber can play an important role in the income of many farmers. It seems an anomaly that farm foresters more frequently choose to insure farm chattels than the trees, an asset which plays an important role in the environment, but is also eventually going to produce an income.

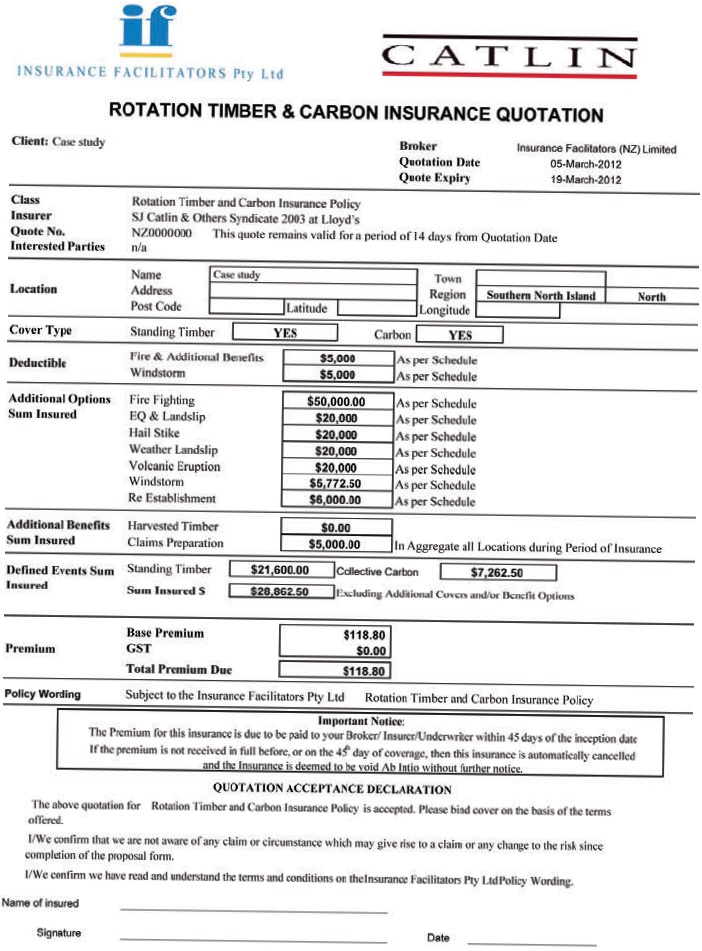

Perhaps the reasons lie with the perception that standing timber insurance is complex or expensive and I hope to help dispel that myth. The insurance company Aon, in association with Insurance Facilitators, has developed special insurance for NZFFA members. There is a choice of cover options and the policy wording is clear and simple for everyone to understand. For every policy placed by Aon and Insurance Facilitators as a result of a referral from the NZFFA we will make a financial contribution to the NZFFA.

About the cover

The main perils that farmers can cover are wind and fire. The fire cover is broad and some policies have wording which excludes fire as a result of natural disaster. The policy is an agreed value one where the farmer simply nominates the value per hectare they require. You should think about the loss happening in the last day of the policy period – what do you need at that time?

You can now also cover the risk of wind damage which can be be a major cause of loss for forest owners. There is nothing quite like looking at a block of mature trees that has taken a hammering from wind. With wind claims we see all kinds of problems. The nature of wind damage means that salvage is difficult, expensive or at times impossible.

It is often back blocks which are damaged, and frequently we find there are no access roads and the owner has to cut down good trees to get to damaged areas. The wind cover we have negotiated is broad, covering the trees being uprooted as well as those which have snapped or are leaning away from vertical.

Small-scale forest owners can take the cover which covers re-establishment costs. If young trees have been affected by wind it may be they are often simply leaning away from vertical and can be ‘righted’. This remedial work allowance saves farmers years of growing time and is a valuable benefit. Farmers can nominate a wind sum insured of up to 20 per cent of the total plantation sum insured, or $2,000,000, whichever is less.

Fire cover

Fire-fighting expenses cover is another very important benefit. This will cover you for reasonable expenses, including imposed levies incurred fighting fires within your forest location.

As many will know the liability under the Forest and Rural Fires Act is broad and we are seeing more and more claims under it. The cost of fire-fighting continues to climb. It does not take much time in a helicopter to clock up hundreds of thousands of dollars. It is also important to consider how you cover third party property damage if, for example, a fire which starts on your property moves on and damages another.

When you set your liability limit you really need to consider a number of factors. Are you close to other houses? Are you near a sawmill or other infrastructures and assets? The topography plays a part – how accessible is your block for fire-fighting? Will helicopters be the main way to fight a fire? How easy is access to water?

The Forest and Rural Fire Act will determine how costs are recovered. The point of ignition is one of the most important aspects. You do not necessarily have to be negligent in any way, just unlucky enough to have a fire start on your block. Some fire-fighting costs recently have been in excess of a million dollars. A few of these have made the news as people find themselves uninsured and facing losing their homes to pay for costs.

Where to from here?

There are other additional benefits to the policy being offered to NZFFA members. For example, the re-establishment costs cover. You nominate a sum insured and this benefit pays for the reasonable costs of debris removal, righting and re-establishment of your standing timber. This includes the costs incurred removing undamaged trees to get access to damaged trees. In addition to standing timber cover, Aon can provide public liability cover.

The information needed to get a quote is very straightforward. To produce a quote we require the name of the insured, plantation location, block age, block species, block insured value per hectare, re-establishment limit, fire-fighting limit, and whether the plantations suffered any damage in the last five years.

Some clients are fortunate enough to have an aerial photograph of the area, and while this is not essential it does help. All the information on the requirements can be found on the NZFFA website where you will see we have provided an easy online quoting facility.

Jo McIntosh is Executive Director of Aon New Zealand based in Wellington.

A bit about us

Insurance Facilitators has been authorised as a cover holder for SJ Catlin & Others Syndicate 2003 at Lloyd’s. Catlin was established more than 25 years ago in London and is the largest syndicate at Lloyd’s based on gross premium written.

Aon New Zealand is part of Aon Corporation, a global insurance broking company. For rural New Zealand, we offer insurance packages specifically tailored to the rural and agribusiness sector.

Farm Forestry New Zealand

Farm Forestry New Zealand