The time for extended rotations has arrived

Stuart Orm, New Zealand Tree Grower November 2019.

Before corporatisation and the reshuffle of the Forest Service the rotation ages for trees in Kaiangoroa Forest often hit 70 years. With the sale of forests to companies which needed a good return on investment we saw the definition of a forest ready for harvest switch from ‘over 30 years’ to a when a stand had saleable logs in it. All this was due to the need to get an economic return on the money invested.

The return was often measured as a target termed the internal rate of return. These rates of return are invariably due to a reduction in the amount of time between investment and return gained – in other words a shorter rotation length. With the advent of income from the carbon as new Zealand Units, and a better understanding of the market, forest owners now have some options where they can get a good internal rate of return, better quality forests and can seriously look at longer rotations as well as planting other tree species.

Changes to the ETS and averaging

The government has announced another round of changes to the Emissions Trading Scheme as part of its review of the scheme. The aim of the changes is to simplify the administration of the ETS, as well as encouraging new planting.

Of interest to forest owners is the introduction of ‘averaging’ as a way of allocating the carbon in the forest. Enduring carbon is the carbon which is retained on-site in the roots and other biomass for as long as the land remains in forest. To date, enduring carbon has been allocated under the saw tooth model. The allocation is a one-off made only to first rotation forests.

For forests planted from 2008 onwards, the amount of enduring carbon is calculated to equate approximately to the carbon accumulated in the first ten years of growth. For forests planted before 2008, the allocation will decline gradually as the forest gets older. For forests planted in 1998 or earlier, the calculations allocate very little or no enduring carbon.

Under the new rules announced in July for averaging, enduring carbon will be allocated differently. It will reflect the average amount of carbon held on land managed under multiple rotations and could be as high as 60 per cent of the total volume expected to be sequestered in the chosen rotation length.

Forest owners with forests planted since 1989 and registered in the ETS have been able to claim the carbon units associated with enduring carbon and trade them without obligation. In other words, they do not have to be concerned about liabilities later on when the forest is harvested as long as the land is re-planted with trees.

Key conditions of the new rules include −

- Only forests which enter the ETS from 2019 onwards will be eligible for averaging

- From the start of 2021, averaging will be mandatory for all forests entering the ETS.

- The amount of enduring carbon allocated will be calculated based on the anticipated rotation length of the first rotation of forest

- All first rotation forests planted after 1989 and entering the ETS for the first time in the years 2019 till the end of 2020 will have the option of either saw tooth or averaging accounting.

Opportunities in averaging

At this stage, the new rules will be of interest to anyone planning new planting from 2019 onwards, and for forest owners who have first rotation post-1989 forests which are not registered in the ETS.

The main aspect to bear in mind is that from now on, the longer the forest rotation, the greater the enduring carbon allocation. For example, if a radiata pine forest is grown on a 30-year rotation, the allocation of enduring carbon will be the equivalent of approximately the first 18 years’ worth of carbon. If the same forest is grown on a 40-year rotation, the allocation of carbon will be the equivalent of approximately the first 23 years’ worth of carbon.

| Rotation length in years | NZU Enduring carbon allocation in New Zealand Units | Enduring carbon in New Zealand Units per hectare | Value at $25 a tonne |

|---|---|---|---|

| 30 | First 18 years | 473 | $11,825 |

| 40 | First 23 years | 650 | $16,250 |

| 50 | First 30 years | 852 | $21,300 |

The table above shows enduring carbon allocation under averaging and is based on a radiata pine forest planted from 2018 onwards in the lower North Island and entered in the ETS from 2019. The exact way carbon will be allocated has yet to be confirmed but we have used a best estimate. Averaging will be available to second and subsequent rotations but not until after the average age has been exceeded – quite possibly after the first 18 years.

From 2021 and beyond

From 2021 onwards New Zealand will be aligned with the rules associated with the Paris climate agreement.

To do this there will probably be two types of ETS accounting systems available to new land and forest registered in the ETS −

- Averaging available to first rotation forest only

- Permanent forest which, as we understand it, will require a 50-year registration extendable in 25-year periods thereafter and which will allow annual carbon allocation for the life of the forest. This will suit indigenous forests and pole planting. Exotic forests managed under a continuous canopy cover will also benefit from this as the rules will probably allow selective harvest for logs as long as a minimum canopy cover of 30 per cent is maintained.

From the information above the main point to understand is that from the start of 2021, a second or subsequent rotation forest will only be able to be registered into the ETS on the averaging accounting as a permanent forest, with the associated delay in receiving carbon .

Register soon

To date we have told clients with older, by that we mean over 20 years, or recently replanted subsequent rotation forest to delay re-registering in ETS with the associated administrative costs. The clock is now ticking, with these forests needing to be in the ETS before the end of 2020 to qualify for carbon credit allocation. We have provided an example below which makes the following assumptions −

- The forest is replanted in 2020 even if you are still awaiting harvest

- The forest is entered into the ETS under the ‘saw tooth’ accounting model

- No carbon will be sequestered in the first 10 years of growth for the replanted forest

- The price of carbon will climb to $50 a unit by 2029, stay there until 2045, and then decrease at two dollars a year until it is six dollars a unit in 2069. This assumes that as we approach 2050 and the successful implementation of the Carbon Zero Bill, or Act as it will be then, that behaviour change will result in a reduced demand for carbon and therefore a declining price.

- The forest is grown on a framing unpruned regime for a 50-year rotation and then harvested.

- Carbon is sold annually and then repurchased at age 49 for surrender at harvest.

- At age 50 the trees are harvested, and carbon surrendered to cover the ETS obligation.

There is obviously no guarantee of the carbon price.

However, with carbon as a legitimate manageable forest product, forest growers can realistically consider longer rotations.

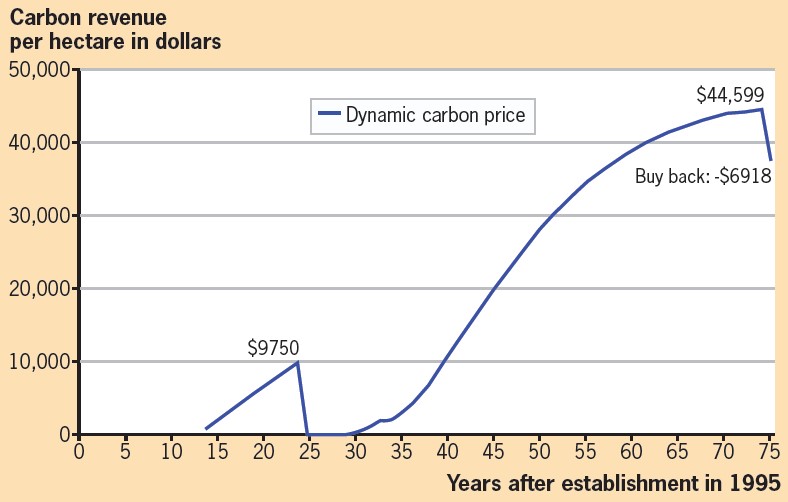

The thick line in the graph shows a dynamic carbon price. In addition the graph shows −

- Total carbon revenue could be $44,599 a hectare

- Surrender costs for 1,153 NZUs a hectare for six dollars a unit in 2069 produces $6,918 a hectare

- Total carbon surplus estimated after buy-back costs are deducted would be $37,681 a hectare

- The annual average surplus would be $753 a hectare

The graph shows only the carbon revenue and buy-back price for the dynamic carbon price model.

It is not a guarantee of what will happen but does demonstrate how a forest owner might take advantage of carbon given the price indications which are being discussed at the moment.

Do not forget the harvest revenue

In addition to the carbon revenues the forest owner will have the harvest to look forward to. The timber revenue will be based on the forest growing and forest management decisions. The timber revenues should be higher than with a shorter rotation as there will be more log volume to sell and the grade mix will be better quality due to the additional time the trees will have had to grow.

Stumpage values of $28,000 a hectare at 28 years could increase to between $40,000 and $50,000 a hectare. The timber revenue could produce an annual average surplus of $800 to $1,000 a hectare over and above potential carbon revenues. This option is only available under the saw tooth carbon accounting method. To benefit from this your forest must be registered in the ETS before the end of 2020. Given the time needed to process the application we would recommend that if interested in doing this you should start the process as soon as possible.

Summary

Never before has a longer rotation and better timber quality forest been as possible as it could be over the next few decades. This is especially likely while carbon prices appear likely to stay firm.

The main thing is to fully understand how a forest, which perhaps was planted in the early 1990s and until now did not appear to have a good carbon potential, can take advantage of the limited time left to enter under the saw tooth model. Realistically there are just 12 months to allow the Ministry for Primary Industries time to complete the processing.

Farm Forestry New Zealand

Farm Forestry New Zealand