The Emissions Trading Scheme Some common missed opportunities

Forest 360, New Zealand Tree Grower November 2020.

In the August issue of Tree Grower our article took us back to basics with the Emissions Trading Scheme. This article outlines some of the missed opportunities for land owners who have existing land and forests planted after 1989 and which, for one reason or another, are not registered for the Emissions Trading Scheme. One deadline to bear in mind is the end of 2022. This is when land owners will lose the chance to enter the scheme under the ‘sawtooth’ carbon allocation option.

There are many forests which could qualify and are not currently registered, and from our experience, the three key missed opportunities are −

- Post-1989 forest which is older first rotation or second rotation

- Indigenous reversion

- Poplar and willow soil conservation planting.

Land eligible for the Emissions Trading Scheme

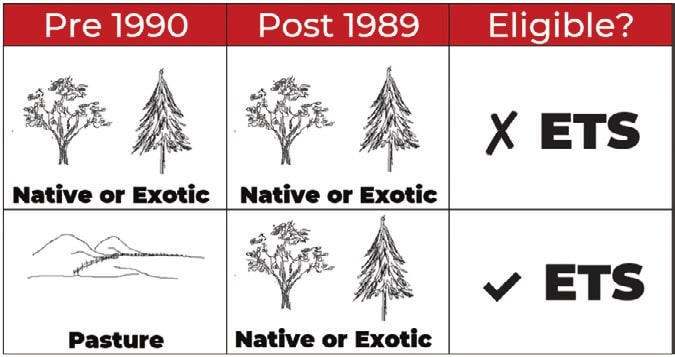

These are the definitions which need to be considered for land to be eligible for the Emissions Trading Scheme −

- It must meet the ‘post 1989’ definition

- Tree species must be able to grow to five or more metres in height

- The area needs to be greater than one hectare

- The average width must be more than 30 metres

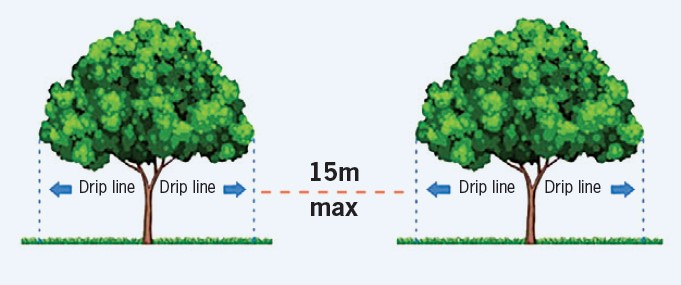

- The potential canopy cover must be more than 30 per cent which means that between 12 metres and 15 metre spacing will achieve this for most species

- There must be less than 15 metres between potential canopy edges of spaced trees

Older first rotation or second rotation planted after 1989

One of the common misconceptions about the Emissions Trading Scheme is that it is not worthwhile entering forests which were planted in the early 1990s or second rotation forests on the same land. This is because there is no ‘safe’ carbon and all credits will have to be surrendered at harvest.

This is true, but not the end of the story. Forest owners could miss out on a number of opportunities if their forest planted after 1989 is not registered before the end of 2022. This is when the option to register under the sawtooth model comes to an end.

The sawtooth model involves the forest owner receiving carbon credits which match the amount stored in the forest as it grows, and then repaying some or all of this carbon at harvest before beginning the whole cycle again in the second and future rotations. For a reminder of what the sawtooth model is see the Tree Grower article in November 2019.

The expense of registering and participating in the scheme is low when compared to the potential opportunities and returns further down the track, especially in these heady days of carbon at $35 a unit. These opportunities include −

- Better marketability and value to a prospective purchaser who may want the option of trading carbon

- Respond to a market opportunity

- Use the credits to fund forest management or the growth of more credits

- Retain credits as a hedge for unforeseen cashflow shortages.

A brief explanation of these four points is below, and a future Tree Grower article will cover some of these scenarios in more depth.

Better value to a prospective purchaser

Forest land which can earn carbon credits has seen significant increases in value, especially with the recent carbon price inflation. As an example, current land values for post-1989 cutover land in the Wairarapa which is, or can be, registered in the Emissions Trading Scheme averages around $5,500 a hectare. Current values for cutover land with no carbon opportunity averages around $3,000 a hectare.

Not all forest land is made equal and this differential will vary from place to place. However, if you own a post-1989 forest, registering for the Emissions Trading Scheme and keeping all options open for a potential buyer provides insurance around obtaining the best price for your land on sale.

Respond to a market opportunity

As a bare bones approach, a forest owner could participate in the Emissions Trading Scheme, accruing credits but not trading. It is important to note that no financial liability is created unless credits are sold or trees are harvested or otherwise lost.

No-one has a crystal ball, but you can give your asset more resilience by having more than one market it can access such as timber and carbon. Your credits in the future could be worth more than the harvest return or vice versa.

Fund the growth of more credits

One challenge of a forestry investment is the need to outlay significant amounts of capital up front and then having to wait many years before receiving any return. Credits accrued by an older forest registered under the sawtooth model can be cashed in and used to offset costs of a new forestry investment.

As long as the new forest is registered in the Emissions Trading Scheme, it can then earn credits to repay the first forest if needed at harvest or credits could be purchased. This first forest will then begin to accumulate credits again once replanted. In this option, credits are actively managed as a resource to even-out cashflow over a long time frame. Discounted cashflow analysis heavily penalises forestry as an investment. However, using carbon credits to offset early expenditure significantly improves the investment case.

Retain credits as a hedge

At the time of writing, the carbon price has reached an all-time high of $35 a unit. The risks of trading carbon and speculating on price may be unmanageable for a forest owner, but there are carbon-leasing companies which understand the carbon market and how 20 years of your carbon allocation can be used to their advantage.

These companies offer forest owners a carbon lease whereby land owners are paid an annual lease for the rights to all carbon sequestered by the forest, with a guarantee of all liabilities being repaid at harvest. If you are risk averse or just do not have the time to trade, this could be an option for you.

Indigenous reversion

Many of you will remember land being cleared, with scrub burned and sprayed back in the 1980s and 1990s. However, once land development grants were phased out from the mid-1990s and the costs of land clearing increased, many land owners gave up and let Mother Nature take charge. As manuka for honey has increasingly become an attractive land-use option, this has further reduced rates of land clearance.

Eligibility is ultimately governed by the Ministry for Primary Industries. However, the following diagram outlines if scrub on your land could be eligible and further investigation is warranted.

The age of your trees will determine the potential amount of carbon you will be allocated. The table below shows potential carbon allocation for one hectare of 5, 10 and 20-year-old indigenous species over the next 10 years. A five-year-old stand of indigenous regeneration, over the next 20 years, at today’s carbon price could earn an average of $334 a hectare each year.

For land owners with substantial areas of reverting land, this amount can add up to an additional income, with minimal chance of ever having to repay liabilities unless for some reason people go back to clearing the land. If you plan to allow native regeneration to continue on your land this could be a low risk option to earn a few more dollars.

| New Zealand Unit per compliance period | ||||

|---|---|---|---|---|

| Species on one hectare | 2018 to 2022 | 2023 to 2027 | 2028 to 2032 | 2033 to 2037 |

| Indigenous age 5 | 22 | 48 | 62 | 60 |

| Indigenous age 10 | 48 | 62 | 60 | 48 |

| Indigenous age 20 | 60 | 48 | 34 | 22 |

| TOTAL NZUs | 129 | 158 | 157 | 131 |

| Price per unit $35.00 | $4,526 | $5,527 | $5,478 | $4,585 |

Poplar and willow soil conservation planting

Poplar and willow planting for soil conservation has been important in Greater Wellington, Hawke’s Bay and Horizons regions since the soil conservation board days. A recent review shows that there are now new and expanding poplar and willow nurseries across New Zealand. This indicates that there are more and more trees being planted for soil conservation which is good news for our rivers and estuaries, and for farmers and their livestock.

The carbon sequestered by poplars and willows can provide an interesting and lucrative revenue stream if they are registered in the Emissions Trading Scheme. This is because you can have your cake and eat it. What we mean by this is that you can have all the environmental and animal welfare benefits such as soil conservation, shade, shelter and possibly fodder in addition to the two revenue streams from stock grazing and carbon. As long as the forest land definition continues to be met over the long-term, there should never be carbon liabilities to repay.

Any planting carried out since 1989 is potentially eligible, and can be bolstered by adding some extra trees if necessary to meet the definition. New planting can easily be designed to meet the required criteria.

Multi-tier income

An average annual carbon revenue over 35 years from poplar and willows is $730 a hectare if the carbon price is $35 for a New Zealand Unit. Working with a modest economic farm surplus of $350 a hectare on a hill country farm this brings your total average revenue to $1080 a hectare − a multi-tier income. Please note that this is an average and there are lower carbon allocations in early years.

Below are some quick tips to meet Emissions Trading Scheme eligibility for poplar and willow planting −

- Ensure it meets the forest land definition

- Perimeter poles should not exceed 20 metres apart at planting although 15 metres is better and aligns with soil conservation guidelines

- Plant willow, and medium-to-broad canopy poplar, at approximately 50 to 60 trees a hectare, 12 to 15 metres apart

- Plant large areas of narrow canopy poplars approximately 80 trees a hectare, 10 to 12 metres apart

- The planting poles should be protected from livestock using sleeves, and cattle should be excluded for at least 18 months after planting

- Poles should be checked regularly over their first few years with any losses replaced

- Planting should be maintained over the longer term to ensure they continue to meet forest land criteria.

General summary

The forest types outlined in this article represent very real and common missed opportunities for land owners. There are not many ways to create multi-tier revenue or access multiple markets from the same hectare of land. The Emissions Trading Scheme provides that opportunity on some properties.

To ensure you can take advantage of all the benefits in full we recommend registering before the end of 2022, which is the end of the next five-year commitment period. In our next article, we will look at more detailed options around older or second rotation forests and the benefits of registering these forests under the Emissions Trading Scheme.

The Forest360 Land Use and ETS team are based in Masterton, but operate nationwide.

Farm Forestry New Zealand

Farm Forestry New Zealand